Unveiling Lendly: Loans, Scams & Ivan Lendl's Millions! [2025]

Ever wondered if accessing quick financial assistance could be both fair and straightforward? Lendly emerges as a potential solution, offering a lifeline for those seeking personal loans ranging from $1,000 to $2,000, especially for individuals who may not have stellar credit scores. But with numerous online lending platforms available, it's crucial to delve deeper into what Lendly offers, its legitimacy, and how it stands out from the crowd.

Lendly is a personal loan provider operating in 12 states across the United States, advertising its services at getlendly.com, aiming to provide Americans with opportunities for financial assistance. The company positions itself as a quick and fair way to borrow, focusing on factors beyond just credit scores, such as employment and income, to determine eligibility. Lendly's loan product is designed with the belief that individuals are more than their credit scores, addressing the challenges faced by those with steady income and secure jobs who struggle to access funds quickly at fair rates. The installment loans offered by Lendly range between $1,000 and $2,000, with a repayment structure tied directly to your paycheck, promising fast funding. Lendly also uses advanced SMS technology to keep you informed about your lending activities, sending notifications for transactions and reminders.

| Category | Information |

|---|---|

| Full Name | Ivan Lendl |

| Birthdate | March 7, 1960 |

| Birthplace | Ostrava, Czechoslovakia (now Czech Republic) |

| Nationality | Czech-American |

| Height | 6 ft 2 in (1.88 m) |

| Residence | Vero Beach, Florida, USA |

| Spouse | Samantha Frankel (m. September 16, 1989) |

| Children | Five daughters: Marika, Isabelle, Daniela, Caroline, and Nikola |

| Net Worth (2025 Estimate) | Over $40 million |

| Primary Sport | Tennis |

| Plays | Right-handed (Eastern Grip) |

| Turned Pro | 1978 |

| Retired | 1994 (initially), briefly returned in 2010 |

| Grand Slam Singles Titles | 8 (Australian Open x2, French Open x3, US Open x3) |

| ATP Singles Titles | 94 |

| Career High Ranking | No. 1 (February 28, 1983) |

| Coaching Career | Andy Murray (2011-2014, 2016-2017), Alexander Zverev (2018-2019), Madison Keys (2022-2024) |

| Official Website/Reference | ATP Tour Profile |

However, before diving into Lendly's offerings, it's important to exercise caution and conduct thorough research. The online lending landscape is fraught with potential scams, and ensuring the legitimacy of a platform is paramount. Some online tools and algorithms provide trust scores based on various data points, such as the website's technology, location, and online presence. For instance, lendli.io has received relatively low trust scores from some sources, raising concerns about its reliability. Similarly, the scam detector website validator has given lendi.org a lower trust score. These lower ratings are often based on an analysis of factors like the use of SSL certificates and the country of origin, among other technical details.

- Movierulz State Vs Nobody 2025 Review Is It Worth Watching

- Filmyfly Your Guide To Bollywood South Indian Movies Online

To further assess Lendly's credibility, it is beneficial to consider its standing with organizations like the Better Business Bureau (BBB). While Lendly, LLC is not a BBB accredited business, this doesn't necessarily indicate fraudulent activity. Accreditation requires a business to adhere to BBB standards for trust and undergo their vetting process. The BBB's website provides information about a company's complaint history, customer reviews, and overall rating, offering valuable insights into its reputation. Lendly.com, on the other hand, has received average to good trust scores from certain sources, suggesting that it is a legitimate and safe platform to use. These positive assessments are often based on an automated analysis of various data sources, including the technology used, the location of the company, and other websites hosted on the same server.

It's also prudent to examine what users are saying about their experiences with Lendly. Online forums and review platforms can provide a wealth of firsthand accounts, revealing both the positive and negative aspects of the platform. Sharing your own experiences in the comments sections of these platforms can contribute to a more comprehensive understanding of Lendly's services. Moreover, it's crucial to be aware of terms that may indicate potential issues, such as whether go.lendli.io has been blacklisted by online directories or tagged as suspicious. Being vigilant about these warning signs can help you avoid falling victim to scams.

In comparison, let's consider an entirely different domain: the world of professional tennis and the legacy of Ivan Lendl. Ivan Lendl, a former world number one professional tennis player, provides a fascinating contrast to the world of online lending. As of 2025, Ivan Lendl's estimated net worth exceeds $40 million, a testament to his successful career and endorsements. Lendl married his wife, Samantha Frankel, on September 16, 1989, and they have enjoyed a happy married life together. His biography reveals a detailed account of his childhood, life, tennis career, achievements, and timeline, offering a glimpse into the dedication and hard work required to reach the pinnacle of professional sports.

- Ultimate Steak Doneness Guide Temp Thermometer Tips

- Is Hdhub4u Safe Trust Scores Legal Risks Of Movie Downloads

While the achievements of Ivan Lendl may seem worlds apart from the services offered by Lendly, both stories highlight the importance of trust, credibility, and thorough evaluation. Just as Lendl built his reputation through years of consistent performance and integrity, Lendly must establish its credibility through transparent practices and reliable service. For individuals considering Lendly for their financial needs, it's essential to conduct thorough research, assess trust scores from various sources, and consider the experiences of other users. By taking these precautions, you can make informed decisions and protect yourself from potential scams in the online lending landscape.

Returning to the specifics of Lendly, it's essential to understand the mechanics of their loan offerings. Lendly's installment loans, which range from $1,000 to $2,000, are funded quickly and repaid directly from your paycheck. This repayment structure can be appealing to individuals who prefer the convenience and security of automated payments. To qualify for a Lendly loan, you don't necessarily need the best credit score; instead, your employment and income may be sufficient. Lendly is an authorized servicer of CCBank, further adding to its credibility.

However, it's important to note that applying for and obtaining a loan through Lendly requires careful consideration. Before signing up, ensure you fully understand the terms and conditions, including interest rates, fees, and repayment schedules. Read the fine print and ask questions if anything is unclear. Be wary of any platform that pressures you to make quick decisions or demands upfront fees, as these are common tactics used by scammers. It's also advisable to check verify.lendli.org with a free review tool to assess its legitimacy and reliability.

Moreover, consider exploring alternative options before committing to a Lendly loan. Compare interest rates and terms from different lenders to ensure you're getting the best possible deal. Look into credit unions, banks, and other financial institutions that may offer more favorable terms. Additionally, explore potential sources of free financial assistance, such as government programs and non-profit organizations.

For those who have already used Lendly's services, sharing your experiences can be invaluable to others. Whether your experience was positive or negative, your feedback can help potential borrowers make informed decisions. Be honest and objective in your reviews, providing specific details about your loan terms, repayment process, and customer service interactions.

Ultimately, the decision of whether or not to use Lendly is a personal one. By conducting thorough research, exercising caution, and considering all available options, you can make an informed choice that aligns with your financial needs and goals. Remember to stay vigilant, protect your personal information, and report any suspicious activity to the appropriate authorities.

In the ever-evolving landscape of online lending, it's crucial to stay informed and adaptable. New platforms emerge regularly, and scams continue to evolve. By remaining vigilant and proactive, you can navigate the online lending world with confidence and protect yourself from potential risks.

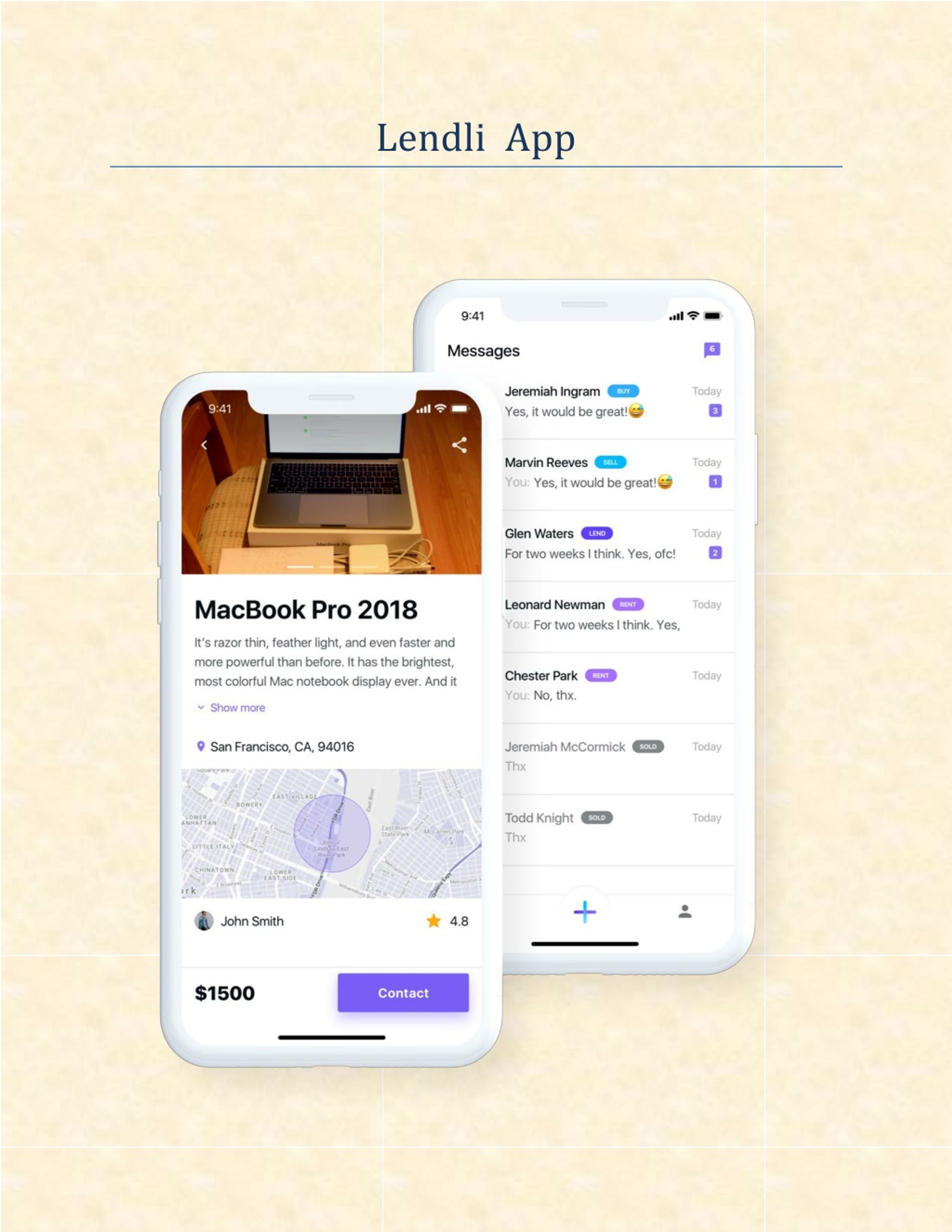

Lendly's aim is to simplify lending and renting, making it accessible to all. The application allows users to input their location and search listings to find the items they want. This contrasts with the educational subreddit focused on scams, which aims to be a wealth of knowledge for people wanting to educate themselves and find support. Lendly, as an operator of an online marketplace, intends to offer the ability to buy and rent personal items. The marketplace filters by location and item, enabling users to rent within their community from individuals and businesses.

Connecting through technology, Lendly uses SMS technology to keep users informed about lending activities and sends reminders. This emphasizes communication. However, it is important to note that factors contribute to a relatively low trust score for Lendli.io, including concerns about it potentially being a scam. The scamadviser algorithm suggests that Lendli.ios review is somewhat low, based on data such as the use of an SSL certificate.

Why does chat.lendli.io have a reasonable trust score? Indications suggest that it might be legitimate. Chat.lendli.io review resulted in a trust score of 61, based on public sources like WHOIS, IP address, and company location. Lendly is presented as an online lender offering small loans between $1,000 and $2,000, with employment and income potentially qualifying applicants, even without the best credit. Lendly is an authorized servicer of CCBank, and the Lendly loan was designed to help people beyond their credit scores, addressing the difficulty of accessing funds quickly at fair rates, even for those with steady income. While Lendly, LLC is not a BBB accredited business, accreditation requires agreeing to BBB standards. Lendli.com is considered to have an average to good trust score, suggesting that it is legitimate and safe. The positive review is based on the technology used, company location, and other websites found on the same server. Lendlys FAQs provide further information for potential borrowers.

All Lendly loan payment history is reported to credit reporting agencies monthly. To sign in, you need your email and password. Sharing experiences in the comments section can provide valuable insights. If go.lendli.io is on any online directories' blacklists or has a suspicious tag, it indicates potential issues. Various tags can define the business. Therefore, a comprehensive evaluation of Lendly's services requires careful consideration of these varied perspectives.

- What Is Masa49 Exploring The Controversial Trend Alternatives

- What Is Masa49 Exploring The Buzz Its Impact Trends

Lendli Product Information, Latest Updates, and Reviews 2025

PPT Lendli App PowerPoint Presentation, free download ID 8852361

Lendli app PDF