PGX Dividend Yield: History, Payout & More - Is It A Good Buy?

Are you searching for a haven in today's turbulent market, a place where your investments can generate steady income? The Invesco Preferred ETF (PGX) might be exactly what you're looking for, offering a compelling dividend yield and a diversified portfolio of preferred stocks.

In a world of fluctuating interest rates and unpredictable economic conditions, the allure of consistent dividend payments becomes increasingly attractive. PGX, with its focus on preferred securities, aims to provide investors with just that a reliable income stream derived from a basket of companies across various sectors. While past performance is never a guarantee of future results, understanding the fund's dividend history, yield, and payout ratio is crucial for making informed investment decisions. This analysis dives into PGX, dissecting its dividend characteristics, comparing it to its peers, and offering insights to help you determine if it aligns with your financial goals.

| Attribute | Value |

|---|---|

| Fund Name | Invesco Preferred ETF (PGX) |

| Asset Class | Preferred Securities |

| Expense Ratio | 0.51% |

| Net Assets | $4.4 Billion |

| Current Dividend Yield (As of May 9, 2025) | 6.19% |

| Annual Dividend Payout | $0.68 per share |

| Dividend Frequency | Monthly (Typically) |

| Inception Date | N/A (Check Invesco's official website) |

| Issuer | Invesco |

| Beta (Latest) | N/A |

Source: Invesco Official Website (For the most up-to-date information)

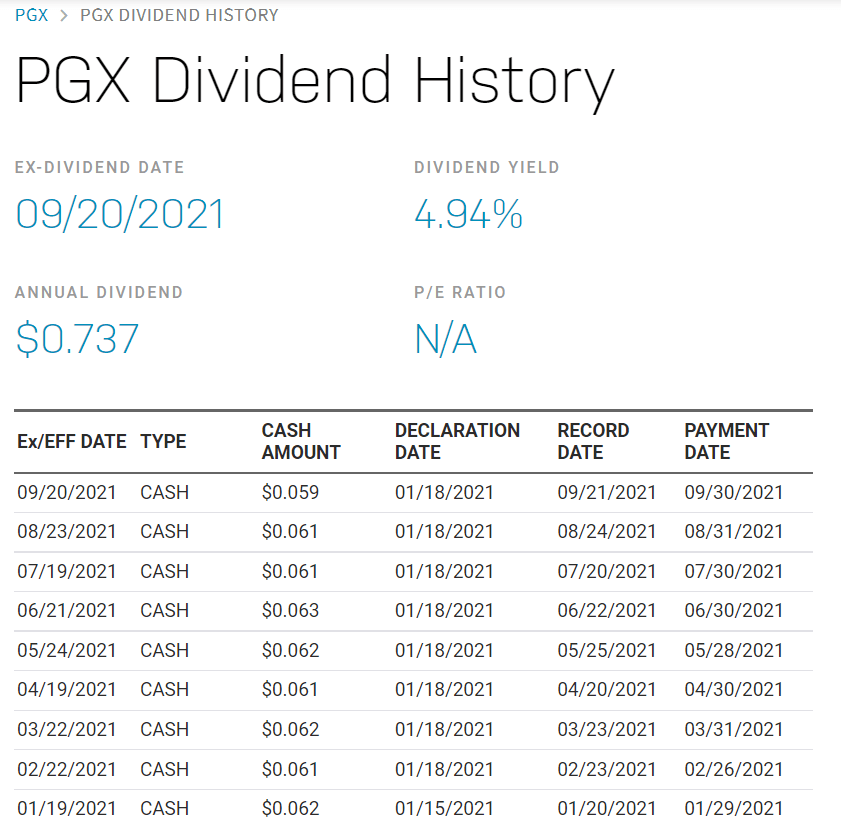

The Invesco Preferred ETF (PGX) has garnered attention from income-seeking investors due to its attractive dividend yield. Recent data indicates that PGX has a dividend yield of 6.23% and distributed $0.68 per share in the preceding year. While sources like "The #1 source for dividend investing" highlight the importance of dividend yields, it's essential to delve deeper into the fund's overall performance and risk profile before making any investment decisions. Understanding the dividend growth history of Invesco Preferred ETF (PGX) is crucial. Analyzing the dividend payouts by month or year can offer insights into the consistency and potential growth of the income stream.

One must always remember that data from the past is not a guarantee of the future, and as of today "Data is currently not available". It's important to cross-reference this information with other reliable sources and consult with a financial advisor to determine if PGX aligns with your investment objectives and risk tolerance. Examining the dividend history of Invesco Preferred ETF (PGX) is essential. A comprehensive analysis, including historical data from 2008, charts, and statistics, can provide valuable insights into the fund's long-term performance and dividend sustainability.

While PGX boasts a solid dividend yield of 6.18%, surpassing the average of the bottom 25% of dividend payers in the US market (0.667%), it's crucial to consider its relative standing within the financial services sector. PGX's dividend yield falls short of the average of the top 25% of dividend payers in the US financial services sector (8.04%), suggesting that there may be other, more attractive dividend ETFs to explore. Potential investors should carefully evaluate these alternatives to determine if they offer a better balance of risk and reward.

- Candace Owens Exposes The Truth Behind Becoming Brigitte Macron

- Hubmasa Safe Platform Or Risky Website The Facts Revealed

Staying informed about Invesco Preferred ETF dividend dates and announcements is vital for any investor in this fund. FX Empire and other financial news outlets provide updates on dividend schedules, payout amounts, and other relevant information. Keeping abreast of these announcements ensures that investors can accurately plan their income streams and make informed decisions about reinvesting or withdrawing dividends. The fund's structure is such that many funds have elected to pay income monthly. This can be particularly appealing to investors who rely on regular income from their investments.

As of Friday, May 09 2025, the current dividend yield for Invesco Preferred ETF (PGX) stock stands at 6.19%. However, it's important to remember that dividend yields are dynamic and can fluctuate based on the fund's stock price and dividend payout. Investors should regularly monitor the dividend yield to ensure it remains aligned with their income expectations and investment goals.

For a comprehensive view of PGX, resources like MarketBeat offer the latest stock price, constituents list, holdings data, and headlines. This information can provide valuable insights into the fund's performance, composition, and potential risks. Analyzing the constituents list, for example, can reveal the sectors and companies in which PGX is heavily invested, allowing investors to assess their exposure to specific industries. The Invesco Preferred ETF (PGX) currently pays an annual dividend of $0.68 per share, resulting in a dividend yield of 6.15%. This figure is subject to change based on market conditions and the fund's performance.

Invesco preferred etf (PGX) was trading at 10.94 +0.05 (+0.46%). This recent price movement, while seemingly small, underscores the dynamic nature of the stock market and the importance of staying informed about market trends. Understanding the factors that influence PGX's stock price can help investors make informed decisions about buying, selling, or holding their shares.

Understanding PGX's classification within the ETF database is crucial. Comparing PGX to its category average and FactSet segment average provides a benchmark for evaluating its performance and risk profile. This comparative analysis can reveal whether PGX is outperforming or underperforming its peers and whether its risk characteristics are aligned with investor expectations. The latest dividend announced for Invesco Preferred ETF (PGX) was $0.0544099994 (04/25/25). This monthly payout contributes to the fund's overall dividend yield and provides investors with a regular income stream.

PGX has net assets of $4.4 billion and an expense ratio of 0.51%. These figures are important for understanding the fund's size and cost structure. A larger asset base can provide greater liquidity and stability, while a lower expense ratio translates to lower costs for investors. Investors should carefully consider these factors when evaluating PGX against other ETFs.

To gain a deeper understanding of Invesco Preferred ETF (PGX), it's essential to explore a variety of resources, including Invesco's official website, financial news outlets, and investment analysis platforms. These resources provide a wealth of information about the fund's performance, holdings, dividend history, and risk profile. By leveraging these resources, investors can make informed decisions about whether PGX is the right investment for their needs.

Exploring the annual payout, 4-year average yield, yield chart, and 10-year yield history of Invesco Preferred ETF (PGX) provides a comprehensive view of the fund's dividend performance over time. Analyzing these metrics can help investors assess the consistency and growth potential of the dividend income stream. For example, a rising 4-year average yield may indicate that the fund's dividend payouts have been increasing over time.

While "We did not find results for:" and "Check spelling or type a new query." are common messages encountered during online searches, they highlight the importance of using accurate search terms and reliable sources when researching investment opportunities. Ensuring that your information is accurate and up-to-date is crucial for making informed investment decisions. Investors should remain vigilant about verifying the information they encounter online and relying on reputable sources for investment research.

In conclusion, the Invesco Preferred ETF (PGX) presents a compelling option for income-seeking investors, offering a relatively high dividend yield and a diversified portfolio of preferred stocks. However, it's essential to conduct thorough research and consider the fund's performance, risk profile, and cost structure before making any investment decisions. By leveraging a variety of resources and consulting with a financial advisor, investors can determine if PGX aligns with their financial goals and risk tolerance. Moreover, consider that the NASDAQ indices and the major indices are delayed. This delay affects real-time data accuracy, which should be accounted for when assessing immediate market conditions. Therefore, make sure to cross-reference information before making financial decisions.

- Decoding The 1851 George Stokes Equation Keyword Explained

- Vegamovies Guide Alternatives Streaming More Year

PGX A Good Preferred Stock ETF (NYSEARCA PGX) Seeking Alpha

The PGX Preferred Securities ETF Offers Attractive Dividend Yields

Swapping Prospect With Carlyle For Solid 11 Yield (NASDAQ CGBD