Unlock High CD Rates: Everbank (Formerly TIAA Bank) Review 2024

Are you seeking a secure haven for your savings while also maximizing your returns? Consider the enticing world of Certificate of Deposit (CD) accounts, a financial instrument that offers a fixed interest rate for a specific term. These accounts provide stability and predictability, making them a popular choice for individuals looking to grow their wealth without the volatility of the stock market.

For those exploring CD options, EverBank emerges as a compelling contender. Formerly known as TIAA Bank, EverBank continues to offer a diverse range of CD terms and competitive interest rates. Let's delve into the details of EverBank's CD offerings and how they stack up against the competition.

| Category | Details |

|---|---|

| Name | EverBank (formerly TIAA Bank) |

| Headquarters | Florida |

| Assets | Over $41 billion |

| Deposits | Over $27 billion |

| CD Terms Offered | 10 different terms, ranging from 3 months to 5 years |

| FDIC Insured | Yes |

| Online Banking | Yes, with convenient online banking services |

| Mobile Deposits | Yes, up to $50,000 per day via mobile app |

| Website | EverBank Official Website |

EverBank's CD offerings provide a spectrum of choices, catering to various investment horizons. Customers can select terms ranging from a short 3 months to a more extended 5 years, allowing them to align their investment strategy with their financial goals. The annual percentage yields (APYs) offered on these CDs are accurate as of May 2, 2025, providing a transparent view of potential earnings. The bank was also recognized as a best CD account of 2024 for its impressive rates and convenient online banking by gobankingrates.

- Perv Therapy Unorthodox Methods Real Results Updated

- Art Terkeursts Life Divorce Remarriage New Chapter

One of the key advantages of EverBank's CDs is the fixed interest rate guaranteed for the entire term. This eliminates the uncertainty associated with fluctuating interest rates, providing peace of mind and predictable returns. Additionally, EverBank distinguishes itself by offering daily compounding, which maximizes the growth potential of your investment.

To explore EverBank's CD rates and terms in detail, individuals can visit the EverBank website. For those who previously held a TIAA brokerage account, the process is straightforward. Simply log in to your account on TIAA.org. Under the "Resources" section, click on "Fixed Income Investments" or select "Fixed Income Research" from the "Research" menu. Locate the "Ready to Invest" section on the right-hand side of the page and click on "Search Now" to view the available CD rates.

EverBank's commitment to competitive rates is evident in its CD offerings. The bank consistently strives to provide rates that are among the highest in the market. For example, current 1-year CD rates at EverBank stand at 2.69 percent with an APY of 2.73 percent. Similarly, 6-month CD rates are also attractive, with a rate of 2.03 percent and an APY of 2.05 percent. These rates position EverBank as a frontrunner in the CD market.

EverBank's predecessor, TIAA Bank, had a long-standing reputation for its CD products. The banking products that TIAA Bank was known for are still offered by EverBank and remain largely unchanged. This ensures continuity and provides customers with the same quality and reliability they have come to expect.

While EverBank offers competitive CD rates, it's always prudent to compare them with those of other banks. Ally Bank, an entirely online institution, is a noteworthy competitor. Ally Bank offers a checking account with a 0.25% APY and a savings account with a 4.20% APY. Although these rates are competitive, EverBank's CD rates often surpass them, making EverBank a potentially more lucrative option for those seeking higher returns on their savings.

EverBank provides a range of CD options, including bump-rate CDs. These CDs allow investors to increase their interest rate once during the term if rates rise. This feature provides flexibility and the opportunity to capitalize on favorable market conditions. However, EverBank bump rate CDs require a $1,500 deposit to open.

In addition to its standard CDs, EverBank also offers CDARS (Certificate of Deposit Account Registry Service) CDs. This unique offering allows depositors to access FDIC insurance coverage on up to $50 million in deposits. Through the IntraFi network, funds placed in a CDARS CD are divided into amounts under the standard FDIC insurance maximum of $250,000 and placed into CDs at other banks. This provides an added layer of security and peace of mind for high-net-worth individuals and businesses.

For those seeking to diversify their investment portfolio, EverBank offers access to CDs through TIAA brokerage accounts. This allows investors to view CD inventory online and incorporate CDs into their overall investment strategy. The minimum deposit for EverBank CDs is typically $1,000, although specific requirements may vary depending on the CD type. Deposits can be made through various methods, including mobile deposits via the EverBank app (up to $50,000 per day) and online transfers between accounts at other banks and EverBank.

EverBank, a member of the FDIC, stands out for its robust CD rates, which consistently outperform those of its competitors. The bank's commitment to providing competitive rates is reflected in its diverse CD offerings and flexible terms. Moreover, EverBank's CDs compound on a daily basis, maximizing the potential for growth. This combination of factors makes EverBank an attractive option for individuals seeking to secure their savings and achieve their financial goals.

One of EverBank's popular accounts is its CD, which continues to offer higher rates than many of its competitors. Unlike some banks, EverBank does not tier its CD rates based on account balance. This means that any account balance earns competitive rates, regardless of its size.

EverBank's Performance CDs offer flexibility, daily compounding, and no monthly maintenance fees, making them an appealing option for those seeking a straightforward and cost-effective investment. The terms range from three months to five years, providing investors with the flexibility to align their investment strategy with their individual needs.

When it comes to exchange rates, EverBank offers a 1% exchange rate advantage. This means that customers enjoy an exchange rate that is within 1% of the rates available to EverBank. This can be particularly beneficial for individuals who frequently engage in international transactions.

To get a better understanding of current EverBank CD rates, here's a quick look at the rates and terms as an example:

| Term | APY | Minimum Deposit |

|---|---|---|

| 3 Months | Varies, check EverBank Website | $1,000 |

| 6 Months | Varies, check EverBank Website | $1,000 |

| 7 Months | Varies, check EverBank Website | $1,000 |

| 9 Months | Varies, check EverBank Website | $1,000 |

It's crucial to note that these rates are subject to change, so it's always recommended to check the EverBank website for the most up-to-date information. The financial landscape is ever-changing, so remaining vigilant and informed is key to ensuring your savings strategy is optimal.

TIAA Bank's CD rates have been historically recognized as some of the highest CD rates available. The transition to EverBank has not diminished this commitment to competitive rates. The bank continues to prioritize offering attractive yields to its customers.

Comparing EverBank's CD rates with those of other banks is a crucial step in making informed financial decisions. By carefully evaluating the offerings of various institutions, you can identify the best CD rates for your specific needs and maximize your potential returns. Remember, a little research can go a long way in ensuring your financial well-being.

A fixed-rate CD will pay the same interest rate throughout the life of the CD, providing stability and predictability. This makes it an ideal choice for individuals who prefer a conservative investment strategy and want to avoid the fluctuations of the stock market.

EverBank is an FDIC-insured online bank with offices located in various regions. As a subsidiary of EverBank, National Association, the bank adheres to strict regulatory standards and provides a safe and secure environment for its customers' deposits.

When it's time to make a deposit into your EverBank CD account, you have several convenient options to choose from. You can make mobile deposits through the EverBank app at any time, up to a limit of $50,000 per day. Alternatively, you can easily make online transfers between your accounts at other banks and your EverBank account. These transfers can be set up one at a time or scheduled on a recurring basis, providing flexibility and convenience.

In addition to its CD offerings, EverBank also provides a range of other banking products and services, including checking accounts, savings accounts, and money market accounts. These accounts cater to various financial needs and provide customers with a comprehensive suite of banking solutions.

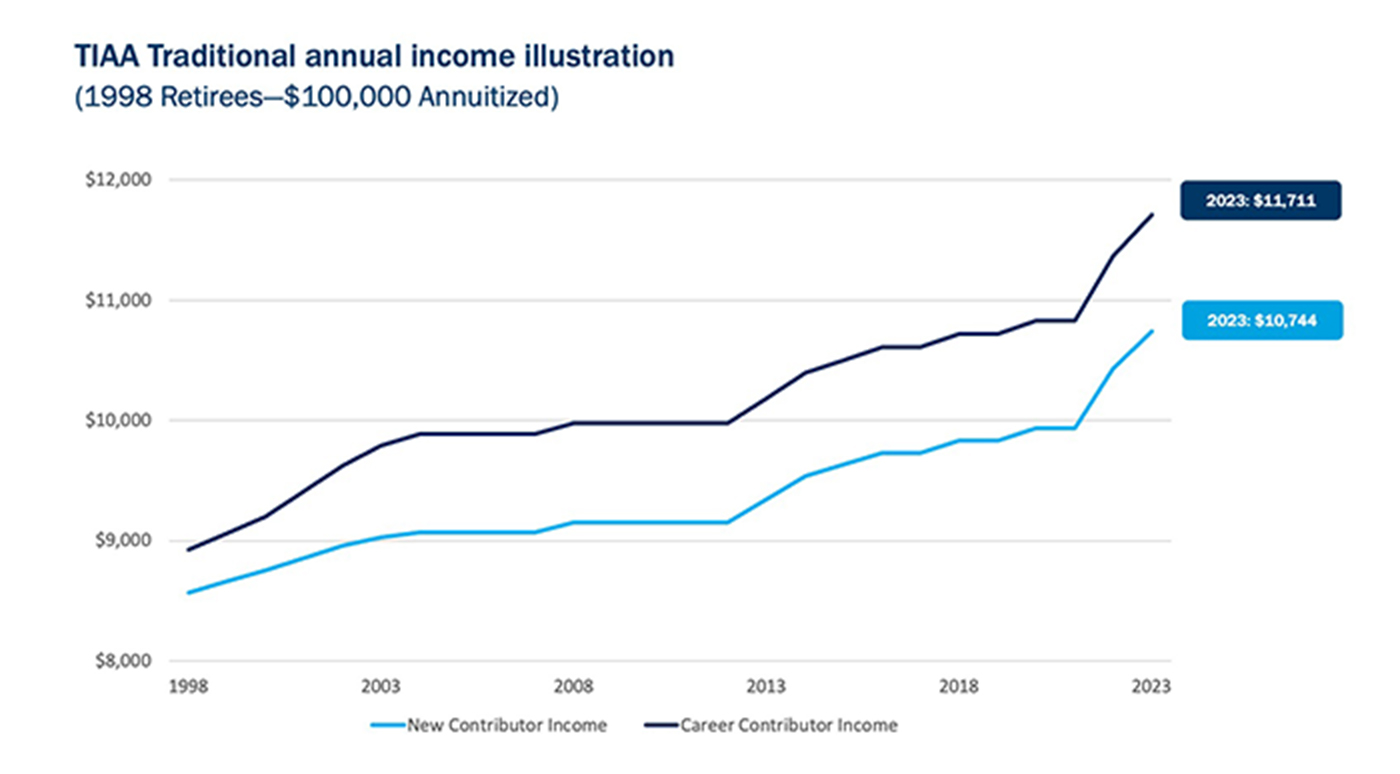

For those seeking alternative investment options, TIAA Traditional and TIAA Secure Income accounts are fixed annuities issued by Teachers Insurance and Annuity Association of America (TIAA), located at 730 Third Avenue, New York, NY, 10017. These annuities offer a fixed rate of return and provide a guaranteed income stream in retirement. Note that these are separate products from EverBank CDs.

Investing in CDs, whether through EverBank or another institution, is a prudent strategy for individuals seeking to preserve capital and earn a guaranteed rate of return. By carefully evaluating CD rates, terms, and features, you can make informed decisions that align with your financial goals. Remember to consider your investment horizon, risk tolerance, and liquidity needs when selecting a CD that's right for you. Consult with a financial advisor to ensure your investment strategy is well-rounded and tailored to your specific circumstances.

The transformation from TIAA Bank to EverBank signifies a continuation of a commitment to providing competitive banking products and services. The core values and principles that guided TIAA Bank remain intact, ensuring a seamless transition for customers. EverBank's dedication to innovation and customer satisfaction positions it as a leading player in the financial industry.

The world of finance can be complex and overwhelming. That's why it's crucial to stay informed and seek guidance from trusted professionals. By understanding the nuances of various investment options, such as CDs, you can make well-informed decisions that contribute to your financial security and long-term prosperity. EverBank, with its diverse CD offerings and commitment to competitive rates, stands as a valuable resource for individuals seeking to grow their wealth and achieve their financial aspirations. Stay informed, stay vigilant, and stay on the path to financial success.

In conclusion, EverBank, formerly TIAA Bank, presents a compelling array of CD options for investors seeking stability and predictable returns. With a range of terms, competitive rates, and convenient online banking services, EverBank caters to a variety of financial needs. By carefully evaluating the bank's CD offerings and comparing them with those of other institutions, you can make informed decisions that align with your financial goals and pave the way for a secure and prosperous future. Remember to always consult with a financial advisor to ensure your investment strategy is well-rounded and tailored to your specific circumstances.

The information presented here is for informational purposes only and should not be construed as financial advice. Always consult with a qualified financial advisor before making any investment decisions. Rates and terms are subject to change without notice. Please refer to the EverBank website for the most up-to-date information.

- Tausha Kutcher Ashton Kutchers Sister Life Career Family

- Movierulz Unblocked Find Alternatives Movie News Year

Tiaa Cd Rates 2025 Kachina Dawn

Tiaa Cd Rates 2025 Kachina Dawn

Tiaa Cd Rates 2025 Kachina Dawn