HELOC Vs. Home Equity Loan: The Ultimate Guide + [Chase Options?]

Staring at that outdated kitchen or dreaming of finally finishing the basement? Tapping into your home's equity could be the answer, offering a powerful financial tool for renovations, debt consolidation, or even big purchases. But which path is right for you: a home equity loan or a HELOC? Understanding the nuances between these two options is crucial to making an informed decision that aligns with your financial goals and risk tolerance.

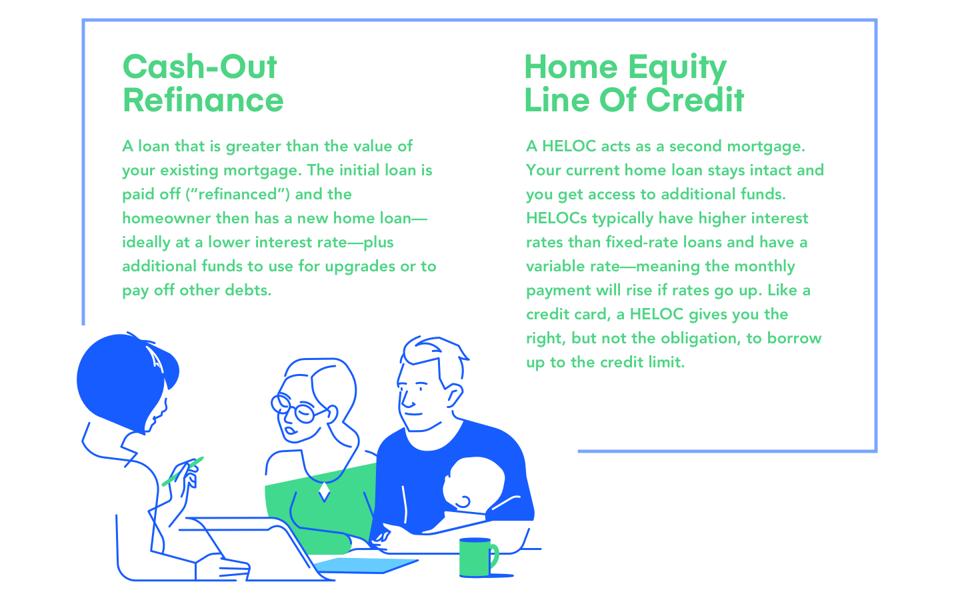

For homeowners, the allure of leveraging the built-up value in their homes is strong. Both home equity loans and HELOCs (Home Equity Lines of Credit) allow you to do just that, but they function in distinct ways. A home equity loan provides a lump sum of cash upfront, offering fixed interest rates and predictable monthly payments, making it suitable for specific, large expenses. On the other hand, a HELOC acts more like a credit card, providing a revolving line of credit you can draw from as needed, often with variable interest rates. Choosing between them depends on your individual needs, financial situation, and risk appetite. Here's a detailed look at what you need to consider.

| Topic | Details |

|---|---|

| Home Equity | The difference between the current market value of your home and the outstanding mortgage balance. |

| Home Equity Loan | A one-time, lump-sum loan secured by your home equity, typically with fixed interest rates and predictable monthly payments. Ideal for financing specific, large expenses like home renovations or debt consolidation. |

| HELOC (Home Equity Line of Credit) | A revolving line of credit secured by your home equity, allowing you to borrow funds as needed during a draw period, often with variable interest rates. Suitable for ongoing expenses or projects where the total cost is uncertain. |

| Chase Home Equity Products | Chase offers Home Equity Line of Credit (HELOC). Chase does not offer Home Equity Loans. |

| HELOC Alternatives at Chase | Chase provides different service to their customer. |

| Where to manage Chase accounts | Chase mortgage services to manage your account. Chase home equity services to manage your home equity account. |

| Important Considerations | Credit scores, debt-to-income ratios, and the potential for variable interest rates. |

| Other Lenders | American Express, Bank of America, Capital One, Citi and Discover. |

| Article Disclaimer | The article is for educational purposes only. Information may vary by lender. Consult with a home lending advisor for specific advice. |

When comparing a home equity loan and a HELOC, the fundamental difference lies in how the funds are disbursed. A home equity loan provides a lump sum upfront, which is advantageous if you have a specific, defined expense in mind, like a kitchen remodel or consolidating high-interest debt. Because you receive all the money at once, you'll immediately start paying interest on the entire loan amount. So, if you take out a $50,000 loan, you'll pay interest on the full $50,000, even if you don't use it all immediately. This contrasts sharply with a HELOC.

- Hdhub4u Is It Safe Risks Alternatives For Streaming Movies

- Did You Mean Tips For Better Search Results

A HELOC, on the other hand, functions as a revolving line of credit, similar to a credit card. You are approved for a certain credit limit based on your home equity, and you can draw funds as needed during a specified "draw period," typically lasting several years. You only pay interest on the amount you've actually borrowed. This flexibility makes HELOCs suitable for ongoing projects, unexpected expenses, or situations where you're unsure of the exact amount of funds you'll need. However, the variable interest rates associated with HELOCs introduce an element of uncertainty into your monthly payments, which can fluctuate based on market conditions.

The interest rate structure is another critical distinction. Home equity loans typically offer fixed interest rates, providing predictability and stability in your monthly payments. This is particularly appealing if you prefer the security of knowing exactly what you'll be paying each month. HELOCs, however, generally come with variable interest rates, often tied to the prime rate or another benchmark. While variable rates may start lower than fixed rates, they can increase over time, potentially making your payments more expensive in the long run. Consider your risk tolerance and financial stability when evaluating these options.

Repayment terms also differ significantly. Home equity loans have a set repayment schedule, typically ranging from 5 to 30 years. Your monthly payments consist of both principal and interest, and you'll make consistent payments until the loan is fully repaid. HELOCs, however, have a draw period during which you can borrow funds, followed by a repayment period. During the draw period, you may only be required to pay interest on the outstanding balance. Once the draw period ends, you'll begin repaying the principal and interest, which can result in significantly higher monthly payments.

- Decoding The 1851 George Stokes Equation Keyword Explained

- Perv Therapy Unorthodox Methods Real Results Updated

Chase, a major player in the financial services industry, offers a specific home equity product: the Chase Home Equity Line of Credit (HELOC). It's important to note that, currently, JPMorgan Chase Bank, N.A., does not offer home equity loans. This means that if you're specifically looking for a home equity loan through Chase, you'll need to explore alternative lenders. However, Chase HELOCs provide homeowners with a flexible way to tap into their property's value, offering funds for home improvements, debt consolidation, or other significant purchases.

Chase HELOCs come with their own set of terms, benefits, and repayment structures. To access, use, and manage your HELOC account, Chase provides online and mobile banking tools, as well as customer service support via phone, fax, email, or mail. Existing Chase home equity customers can easily reach customer service through these channels. These resources help borrowers understand how to utilize their extra funds effectively and manage their HELOC account responsibly.

While Chase doesn't offer home equity loans, there are numerous other lenders in the market that do, including American Express, Bank of America, Capital One, Citi, and Discover. When comparing home equity loans from different lenders, it's essential to consider several key components. Factors like interest rates (fixed or variable), loan terms, fees, and eligibility requirements can significantly impact the overall cost and suitability of the loan. It's crucial to shop around and compare offers from multiple lenders to find the best terms for your specific situation.

When considering the requirements for home equity loans and HELOCs, lenders typically assess several factors, including your credit score, debt-to-income (DTI) ratio, and the amount of equity you have in your home. A higher credit score and a lower DTI ratio generally increase your chances of approval and may qualify you for more favorable interest rates. Lenders also want to ensure that you have sufficient equity in your home, typically requiring you to borrow no more than 85% of your home's equity.

The pause in HELOC programs by some banks during the coronavirus pandemic highlights the inherent risks associated with these types of loans. The uncertainties in the housing market prompted some lenders to temporarily suspend their HELOC offerings. This underscores the importance of carefully evaluating your financial situation and risk tolerance before taking out a home equity loan or HELOC. Economic downturns or significant changes in your personal circumstances can impact your ability to repay the loan, potentially putting your home at risk.

If you're exploring alternatives to Chase home equity products, Fourleaf Federal Credit Union offers HELOCs up to $1 million, which may be higher than the limits offered by some other lenders. Additionally, qualified borrowers with a VantageScore of 720 or above may benefit from a low fixed interest rate for the first 12 months on HELOCs of $25,000 or more. These types of promotional offers can make HELOCs an attractive option, but it's essential to carefully review the terms and conditions to understand the long-term implications.

Understanding how home equity loans are used is crucial. Homeowners often use these funds for home renovations, debt consolidation, or other significant purchases. Renovating your home can increase its value and improve your quality of life. Consolidating high-interest debt, such as credit card balances, can lower your monthly payments and save you money on interest charges. However, it's essential to use these funds responsibly and avoid accumulating new debt.

While a home equity loan provides a lump sum, offering a sense of immediate financial relief, it's important to remember that you'll be paying interest on the entire loan amount from the outset. This contrasts with a HELOC, where you only pay interest on the funds you actually draw. If you're disciplined with your spending and only borrow what you need, a HELOC can potentially be a more cost-effective option.

Similarities exist between HELOCs and home equity loans. Both are secured by your home equity, and both can be used for similar purposes. However, the differences in disbursement, interest rates, and repayment terms make them suitable for different financial situations. Understanding these nuances is crucial to making an informed decision.

To explore price options for tapping into your home equity, consider using a home equity loan calculator. These calculators can provide an estimate of potential loan amounts, interest rates, and monthly payments. Keep in mind that these are just estimates, and the actual terms of your loan will depend on your credit score, DTI ratio, and other factors.

For current Chase mortgage customers, managing your account is straightforward. You can make mortgage payments, get information on your escrow, submit an insurance claim, request a payoff quote, or sign in to your account through Chase's online portal. Similarly, Chase home equity customers can manage their home equity accounts online, accessing account information, making payments, and tracking their borrowing activity.

While home equity loans can be a valuable financial tool, it's essential to be aware of the risks. Because these loans are secured by your home, you could lose your home if you fail to make payments. Additionally, the interest rates on home equity loans may be higher than other types of loans, particularly if you have a lower credit score or a higher DTI ratio.

It's important to note that JPMorgan Chase Bank, N.A., does not currently offer home equity loans or home equity lines of credit (HELOCs) in all states. Availability may vary depending on your location. Therefore, it's crucial to talk with a home lending advisor to determine if these products are available in your state.

Remember that any information described in this article is for educational purposes only and may vary by lender. The terms and conditions of home equity loans and HELOCs can differ significantly between lenders. Always consult with a qualified financial advisor before making any decisions about borrowing against your home equity.

While this article provides a general overview of home equity loans and HELOCs, it's not a substitute for professional financial advice. Every homeowner's financial situation is unique, and it's essential to consider your specific circumstances before making any decisions.

- Who Is David Boons Family Wife Children More

- What Is Masa49 Exploring The Controversial Trend Alternatives

Chase Home Lending BrandVoice How To Tap Into Your Home’s Equity

Chase Mortgage and Home Equity review Top Ten Reviews

Chase Mortgage and Home Equity review Top Ten Reviews